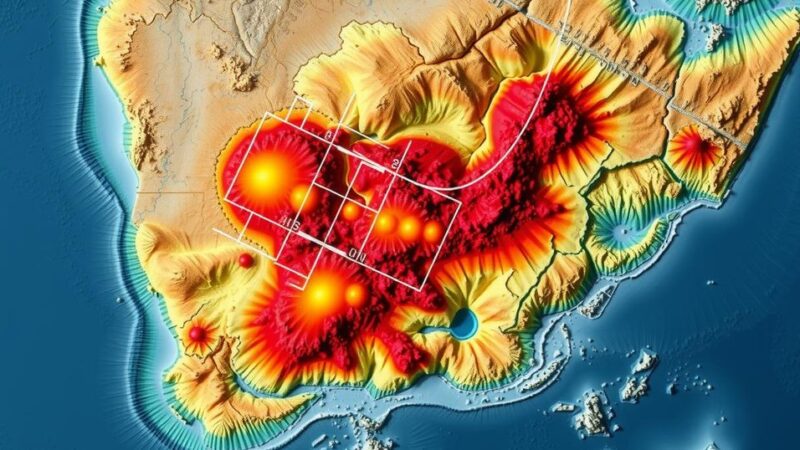

Zambia and Botswana are exploring the creation of sovereign wealth funds to address fiscal instability amid ongoing revenue and spending pressures. Zambia’s economic woes, exacerbated by drought, call for a rainy day fund, while Botswana seeks to utilize its mineral wealth. However, both countries confront significant structural challenges that may hinder the effectiveness of these initiatives.

Zambia and Botswana, two nations in southern Africa, are currently exploring the establishment of sovereign wealth funds (SWFs) aimed at fiscal stabilization. This initiative arises amidst significant revenue and expenditure pressures exacerbated by their respective structural challenges. The economic landscape in Zambia, particularly affected by drought, has impelled the government to contemplate the creation of a rainy day fund despite the pressing economic climate. With budgetary constraints impacting both countries, the proposed plans for these funds may ultimately be insufficient to address the systemic issues they face. Meanwhile, Botswana grapples with its own economic pressures and the exploration of mineral wealth utilization in creating a SWF. However, both countries must confront their operational hurdles and address their financial governance effectively to make this initiative successful, lest the implementation proves to be an inadequate response to their broader fiscal challenges.

The concept of sovereign wealth funds (SWFs) has gained traction among nations seeking to stabilize their economies in the face of revenue volatility and fiscal pressures. In the case of Zambia and Botswana, the focus on mineral wealth as a foundation for these funds highlights the potential for resource-driven strategies in economic recovery. With Zambia experiencing severe drought conditions adversely affecting agricultural output and revenue generation, the necessity for a more robust financial strategy is paramount. In contrast, Botswana, with its rich mineral extraction industry, seeks to leverage these resources to develop a fiscal tool that can mitigate economic downturns. Therefore, the establishment of SWFs could represent a pivotal shift toward sustainable economic management if executed with foresight and systemic planning.

In summary, while both Zambia and Botswana are poised to initiate sovereign wealth funds as a means of fiscal stabilization, it is critical to recognize the inherent challenges they face. Economic structural limitations and the pressing need for comprehensive governance reforms must be addressed if these funds are to succeed. Ultimately, the efficacy of these sovereign wealth funds hinges not only on their establishment but also on the ability of both nations to confront and resolve the underlying fiscal constraints that have historically impeded economic stability.

Original Source: globalswf.com