Kenya is in negotiations for a $1.5 billion commercial loan from the UAE at an interest rate of 8.25%. Finance Minister John Mbadi indicated this loan is a more cost-effective option than previous Eurobond borrowings. The government is also addressing concerns raised by the IMF regarding the risks of external debt exposure. This loan aims to reduce local borrowing and support the government’s broader economic goals.

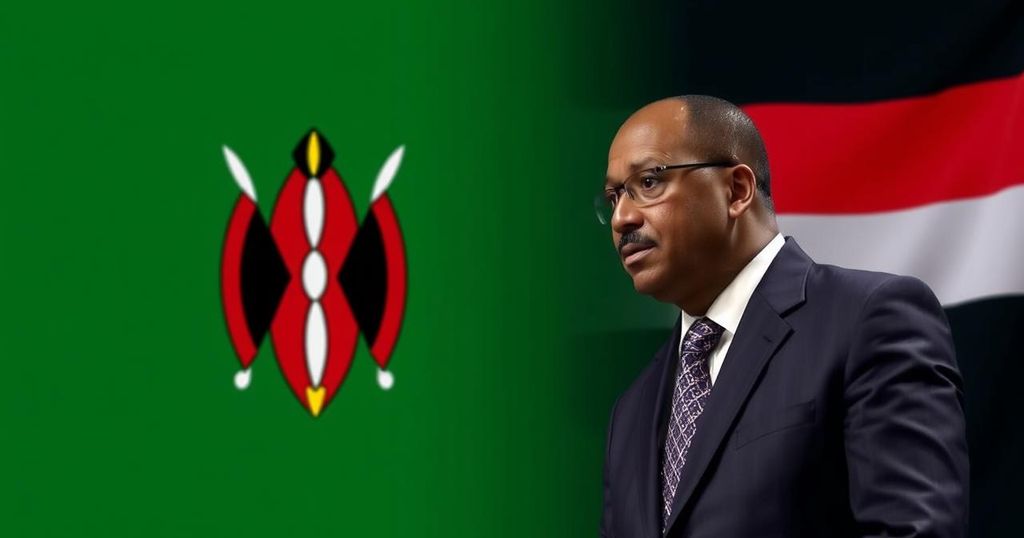

Kenya is currently negotiating a substantial commercial loan of $1.5 billion with the United Arab Emirates, which carries an interest rate of 8.25% and a tenor of seven years, as announced by Finance Minister John Mbadi during a press conference on Wednesday. This move is part of the East African nation’s strategy to broaden its financing sources, particularly in light of recent civil unrest that compelled the government to retract various proposed tax increases and led to postponed financial disbursements from the International Monetary Fund (IMF). Minister Mbadi pointed out that this loan represents a more favorable financial option compared to the recent Eurobond borrowing of $1.5 billion issued in February at an interest rate of 10.7%, which was intended to partially refinance a maturing $2 billion Eurobond. Nevertheless, the Kenyan government is coordinating discussions with the IMF, which has raised concerns regarding the potential risks associated with this external, dollar-denominated loan. The Minister acknowledged the IMF’s reservations regarding the additional financial exposure this loan could create. “There are issues to be discussed, including with the IMF, which had expressed some reservations, because we are talking about this being an external loan and is dollar denominated, it may expose us to additional risk,” he articulated. Ultimately, the government argues that this commercial loan presents a less costly alternative than other financing avenues, including additional Eurobonds. The foreign borrowing target established for the current financial year is set at 168 billion shillings (equivalent to $1.31 billion), while the UAE loan, if finalized, would amount to approximately 195 billion shillings, thereby decreasing the necessity for local borrowing. Furthermore, President William Ruto’s administration has made it a priority to reduce the prevailing high lending rates in the economy to promote business activities and foster economic growth. Although the central bank’s benchmark lending rate was recently lowered by 75 basis points to 12%, this remains elevated compared to the targeted rate of 10% or lower, according to Minister Mbadi. It is pertinent to note that since President Ruto assumed office in September 2022, Kenya has sought to strengthen its relationships with the UAE. For instance, the government selected several Gulf firms, including the UAE’s Abu Dhabi National Oil Company (ADNOC) and Emirates National Oil Company, to supply oil to Kenya under longer credit terms, marking a departure from the previous open tender procurement process.

The discussions surrounding the $1.5 billion commercial loan from UAE are indicative of Kenya’s broader economic strategy in light of recent financial challenges. Following civil unrest that led to government policy reversals regarding taxation, Kenya seeks to alleviate its financial pressure amidst delayed funding from the IMF. By engaging with the UAE for a loan with a lower interest rate compared to previous Eurobond issuances, Kenya aims to diversify its sources of finance and reduce local borrowing needs. The ongoing dialogue with the IMF also highlights the delicate balance that Kenya must maintain regarding its external debt and financial obligations.

In conclusion, Kenya is pursuing a $1.5 billion commercial loan from the UAE at a more favorable interest rate than its previous Eurobond issuance, as part of its efforts to diversify funding sources amidst recent economic turmoil. The government continues to engage with the IMF concerning the potential risks associated with this loan. Strengthening ties with the UAE not only reflects an evolving geopolitical landscape but also underscores Kenya’s proactive approach to enhancing its financial stability. The outcome of these discussions will be crucial for the country’s economic recovery and growth.

Original Source: www.zawya.com