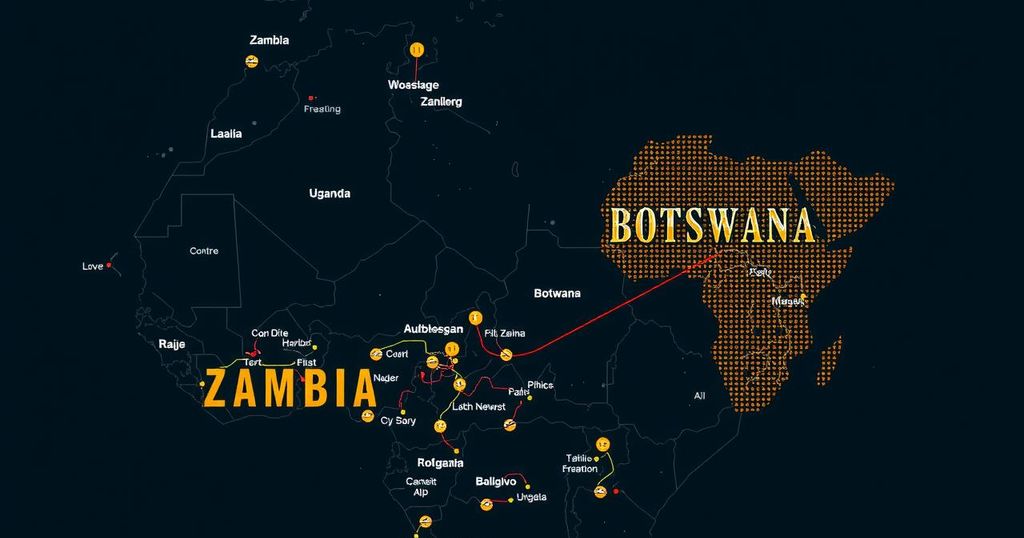

Standard Chartered Plc is contemplating the sale of its wealth and retail banking segments in Botswana, Uganda, and Zambia to reallocate capital to more profitable areas of its business. The bank, which has experienced significant growth in its wealth management on the continent, recognizes that its ventures in these countries may not yield substantial returns. This decision reflects a broader trend among international banks reassessing their African operations.

Standard Chartered Plc is considering divesting its wealth and retail banking units in three African nations—Botswana, Uganda, and Zambia—as part of a strategic initiative to release capital for reinvestment in more promising sectors of its business. The bank asserts that the anticipated financial repercussions from these potential exits would be negligible and frames these sales as a part of a broader evaluation of its operational effectiveness across global markets. Despite significant growth in its African wealth management portfolio, much of this expansion is attributed to stronger markets in Kenya and Nigeria, with Botswana, Uganda, and Zambia not ranking amongst the continent’s wealthier nations.

Standard Chartered’s assessment of its African operations is reflective of a trend among various international banking institutions aiming to recalibrate their focus on more lucrative markets. The bank has successfully doubled its assets under management in African wealth management over the last three years, predominantly driven by its activities in Kenya and Nigeria. The current exploration of divestitures in less profitable markets aligns with the bank’s strategic objective to allocate resources efficiently in pursuit of its most compelling client propositions, as noted by the Chief Executive Officer Bill Winters.

The potential exit from Botswana, Uganda, and Zambia represents a calculated decision by Standard Chartered to streamline its operations and reinforce its presence in more advantageous markets. This strategy is not an isolated case, as it aligns with broader actions taken by other global financial institutions to optimize their African operations. The bank remains committed to its growth ambitions, particularly in regions that offer the best prospects for its wealth management services.

Original Source: www.bnnbloomberg.ca