Donald Trump’s impending presidency is prompting financial markets to adjust focus to potential policy changes. While historical trends suggest strong stock market performance irrespective of party, investor sentiment leans towards hope for tax cuts and deregulation despite concerns over tariffs. The resilience of the U.S. economy and sectors like Financials is underscored, while the need for a disciplined value investing strategy is emphasized in light of uncertainties.

As Donald Trump prepares to take office as the 47th President of the United States, financial markets are shifting their focus towards the anticipated policies of his administration. Traditionally, the U.S. stock markets have shown significant performance irrespective of the ruling party. However, investor sentiment is currently influenced by expected tax cuts and deregulation, juxtaposed against lingering concerns regarding tariffs and trade disputes. These anticipated policy changes bear considerable implications for corporate profitability, economic expansion, and overall market performance.

Since the election, the Financials sector has notably excelled, propelled by expectations of reduced regulatory burdens. The resilience of the U.S. economy is evident, with a projected Q4 GDP growth rate of 2.7% and strong job creation figures. Companies such as Eaton PLC and Caterpillar are particularly benefiting from optimism surrounding their strong performances and robust long-term growth potential, thanks to infrastructure investments and a supportive regulatory climate for industrial demand.

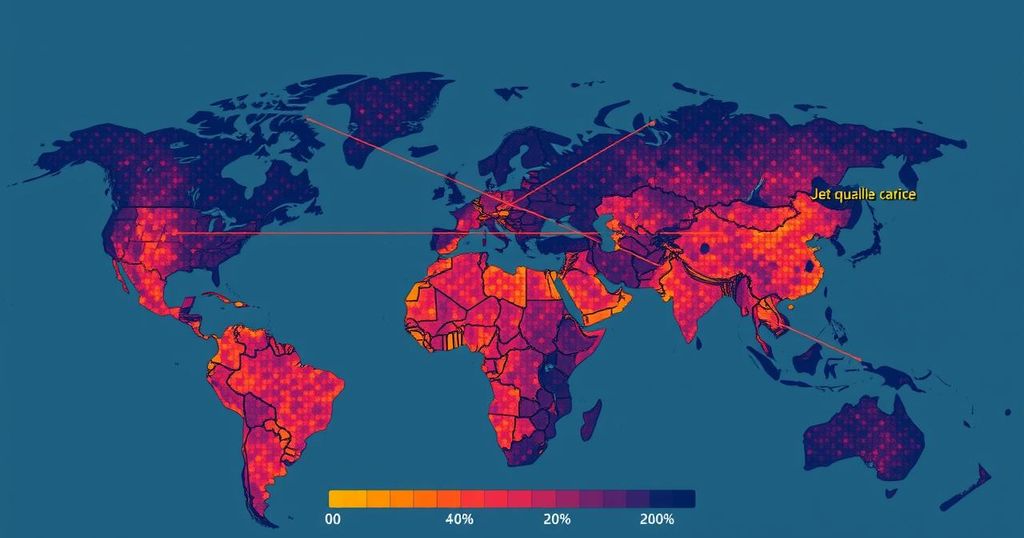

Nonetheless, threats such as President-elect Trump’s proposed tariffs on imports from Mexico and Canada present uncertainties that may affect supply chains and fuel inflation. While some manufacturers could face challenges due to these tariffs, others regard them as negotiation strategies intended to enhance American production capabilities. Firms with a domestic operational focus are likely to be better positioned to adapt, presenting potential investment opportunities. Both Eaton and Caterpillar, with their experienced management teams, are expected to navigate potential trade disruptions effectively.

Investors are encouraged to adopt a disciplined value investing strategy amid the evolving market landscape. Allocating funds to stocks with solid fundamentals, compelling valuations, and dependable dividends is essential for achieving long-term investment success. Historical trends suggest that value stocks outperform during transitional economic phases. As Warren Buffett has conveyed, placing long-term bets against America is rarely prudent.

The upcoming 2024 election signals the onset of a new economic phase filled with both challenges and opportunities. By diversifying their portfolios and maintaining a long-term investment perspective, investors can exploit the shifting market dynamics. The core tenets of steadfast focus, disciplined strategies, and sustained investment engagement remain crucial.

The article discusses the anticipated economic and market dynamics following the election of Donald Trump as the U.S. President. It outlines how stock market performance may be influenced by potential policies, particularly in regard to taxation and regulation, while also addressing risks related to tariffs and inflation. Key sectors, particularly Financials, are highlighted as primary beneficiaries of a favorable regulatory environment. Overall, the article emphasizes the necessity for investors to adopt a prudent, long-term investment strategy amid the uncertainties of political changes.

In conclusion, the article highlights the intersection of political change and economic performance, urging investors to remain vigilant in navigating the potential impacts of new policies. The resilience of the economy, illustrated by strong GDP growth and corporate earnings, offers opportunities while also raising concerns over potential risks associated with proposed tariffs. Adopting a disciplined value investing approach will be pivotal in capitalizing on these market challenges and opportunities moving forward.

Original Source: www.forbes.com