YPF is implementing a divestiture plan involving offshore projects in Argentina and Uruguay, aiming to reduce costs by $512 million through 2026. The company is focusing on a major LNG project with targeted exports beginning in 2027, while planning investments of $5 billion this year. YPF successfully reversed a previous loss into a profit in the past fiscal year.

Argentina’s state-controlled energy company YPF is strategically moving to enhance its operations by divesting from offshore exploration projects in both Argentina and Uruguay. CEO Horacio Marin announced this initiative, which aims to reduce involvement in mature fields while potentially selling a gas distribution company as well. YPF currently holds exploration rights across seven offshore regions, comprising six off its coast and one near Uruguay.

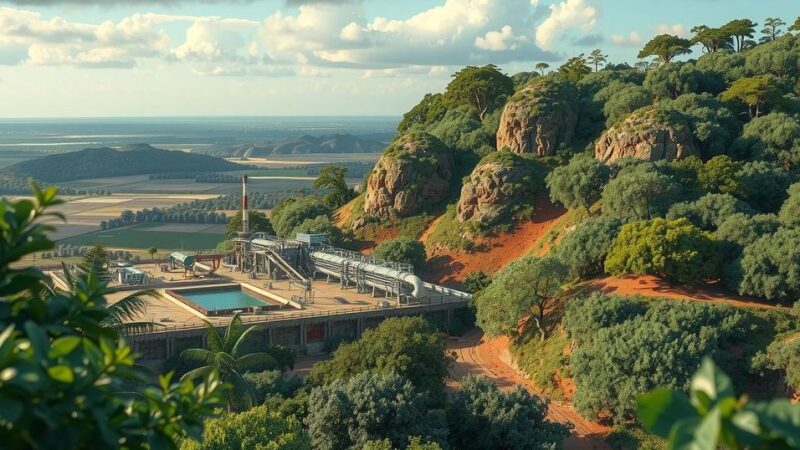

As YPF intensifies its oil and gas output in the prolific Vaca Muerta formation, this divestiture will allow the firm to concentrate on major projects, including a substantial liquefied natural gas (LNG) development aimed at commencing the nation’s first LNG exports by 2027. Marin revealed that discussions are underway with an international oil company to sell part of the exploration stake in Uruguay, with plans for additional offshore interests to be put up for bidding.

The decision on a floating LNG facility, part of the first phase of the LNG project, must be finalized by June. This initial phase intends to yield around 6 million metric tons of LNG annually via up to two production vessels. YPF aims to maintain a 25% to 30% stake in this project, which is designed to achieve a total capacity of 30 million metric tons annually, possibly partnering with major players including Shell.

Last year, YPF successfully reduced $405 million in downstream expenses and is on track to cut an additional $512 million by 2026. The company reported a profit increase to $2.39 billion, a significant turnaround from a $1.28 billion loss the year prior, and plans to invest approximately $5 billion this year, consistent with 2024 projections.

In conclusion, YPF is actively pursuing a divestiture strategy to enhance its focus on large-scale developments, particularly the LNG project aimed at establishing Argentina’s LNG export capabilities. The company’s proactive measures in cutting costs and reallocating investments signify its commitment to financial stability while undertaking significant energy initiatives.

Original Source: www.marketscreener.com