On March 14, Turkey’s lira was at 36.6845 to the USD, with the BIST 100 index up 1.39%. Global markets showed signs of recovery, while President Erdogan and other officials attended significant events. Turkey’s military operations against Kurdish militants continue, along with rising expenditures on retiree benefits. Turkey’s central bank aims for a 24% inflation target, highlighting its crucial role in European security restructuring.

On March 14, key factors influencing Turkish financial markets include the Turkish lira’s exchange rate against the U.S. dollar, which was quoted at 36.6845 at 0512 GMT, slightly higher than the previous close. The BIST 100 share index saw a rise of 1.39%, closing at 10,727.58 points on the prior Thursday, indicating positive market activity.

In the global context, Asian shares increased, and there was a slight recovery in global markets after considerable selling pressure. Gold prices hit a record as global trade tensions heightened, prompting investors to seek safer assets.

President Tayyip Erdogan is scheduled to meet Denis Becirovic, a member of Bosnia’s presidency, in Istanbul and will later host a Ramadan fast-breaking dinner with healthcare professionals. Meanwhile, Transport and Infrastructure Minister Abdulkadir Uraloglu will engage in multiple activities in Gaziantep, including meetings with local officials and a community dinner.

Culture and Tourism Minister Mehmet Nuri Ersoy will participate in a ceremony in Antalya to receive artefacts returned from Denmark. Additionally, Turkey’s Foreign Minister, Defence Minister, and Intelligence Chief are currently visiting Damascus for discussions of an undisclosed nature.

Numerous independent media outlets face closure risks due to recent algorithm changes by Google that have severely diminished their traffic, according to a joint statement from these outlets. Turkey anticipates an increase of 50.4 billion lira ($1.38 billion) in expenditure on retiree allowances and maternity benefits this year, as stated in an impact analysis report.

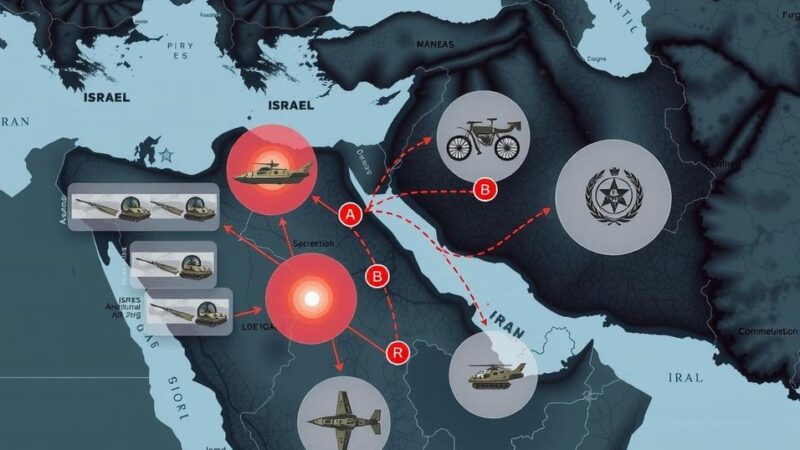

In security matters, Turkish forces reportedly killed 24 Kurdish militants in operations in northern Iraq and Syria, following disarmament calls from PKK leadership and agreements between U.S.-backed Kurds and Damascus. Regarding monetary policy, Turkey’s Central Bank reaffirmed its commitment to achieving a year-end inflation target of 24% through a rigorous approach, as articulated by Governor Fatih Karahan.

Diplomatic sources highlight Turkey’s emerging role as a critical partner in reconfiguring the European security architecture, particularly as Europe seeks to enhance its defense strategies and security guarantees for Ukraine amidst tragic regional conflicts.

For more insights, related news can be found in categories including Turkish politics, equities, currency, and debt. Daily updates and live quotes are also available for the Istanbul National-100 stock index and interbank lira trading.

In summary, several factors are poised to influence Turkey’s financial markets, including currency exchange rates, stock index performance, and ongoing political and economic developments. Notably, Turkey’s engagement in international diplomacy and domestic policy initiatives will play a significant role in shaping market reactions. The current climate indicates both challenges and opportunities as the nation navigates through economic pressures and international relations.

Original Source: www.tradingview.com