Mohammed Al-Najjar discussed investment opportunities in Iraq, highlighting the energy and real estate sectors as the most attractive for investors. He noted challenges such as the need for legal reforms and provided insights into the current landscape of international investments and agreements in the country.

On Thursday, Mohammed Al-Najjar, the Prime Minister’s Advisor for Investment Affairs, outlined the primary sectors drawing interest from local and foreign investors in Iraq, while also addressing existing challenges. He emphasized that most international agreements have been executed, with others set for activation soon.

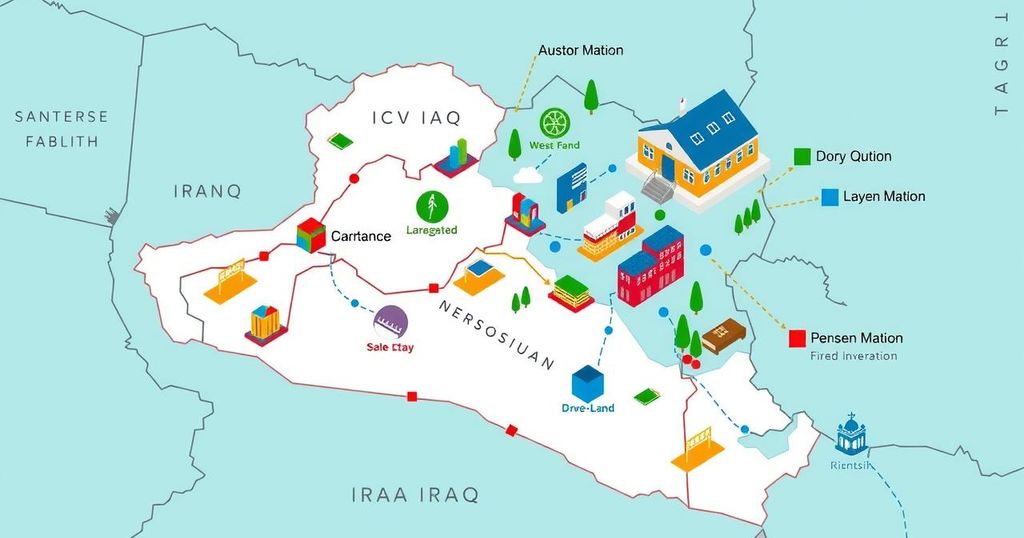

Al-Najjar pointed out that the energy sector and real estate development are leading areas for attracting investments, which bring substantial funds. Conversely, the industrial sector, services, and agriculture rely heavily on domestic investment, with foreign participation being less than anticipated, albeit some modest investments persist in the energy sector.

Moreover, he indicated a palpable interest in exploring the Iraqi market, with some initiatives reaching decision-making stages, while others remain under consideration. However, he noted key obstacles such as the absence of a transparent legal framework for foreign investors, necessitating amendments to existing laws to align with contemporary standards.

The advisor highlighted the main countries investing in Iraq, with France leading through its Total contract, followed by Britain via the Bibi contract. He also mentioned that while some Saudi investments exist, they are contingent upon protective measures that are pending Parliamentary approval. Additionally, there are varied Gulf and Egyptian investments currently under review.

Furthermore, Al-Najjar expressed a strong commitment to fulfilling international agreements, although some are impeded by legal issues, exacerbated by the recent impacts of the conflict on October 7. He explained that many agreements involve bilateral negotiations, which require time for successful implementation, with some already underway while others are in progress.

In summary, Iraq presents attractive investment opportunities primarily in the energy and real estate sectors, amidst ongoing challenges relating to the legal environment for foreign investments. Despite international agreements being executed, certain laws require amendment for better investor assurance. The landscape remains optimistic as various countries continue to explore potentials in the Iraqi market, despite challenges posed by recent conflicts and legislative hurdles.

Original Source: ina.iq