Sudan’s gold industry plays a critical role in financing the ongoing conflict, with the UAE as the primary destination for this trade. Despite official declarations of record gold production, much of it is smuggled, contributing to the war’s continuation. Legal actions against the UAE highlight the complexities of this trade, which sustains both military factions in Sudan.

Sudan’s gold industry has emerged as a crucial element in financing the ongoing conflict. The vast majority of this gold trade is routed through the United Arab Emirates (UAE), benefiting both the national army and paramilitary forces, as reported by various officials and NGOs. Despite the significant economic devastation caused by the two-year conflict, the Sudanese army-backed government announced record gold production for 2024.

The demand for Sudan’s extensive gold reserves is believed to prolong the war. Economist Abdelazim al-Amawy stated that following gold trade routes leads directly to the UAE. Marc Ummel, a researcher with Swissaid, indicates this linkage is vital to understanding the conflict’s dynamics. Although a UAE official dismissed the allegations of gold smuggling, Sudanese sources confirmed that nearly all gold transactions are linked to Emirati entities.

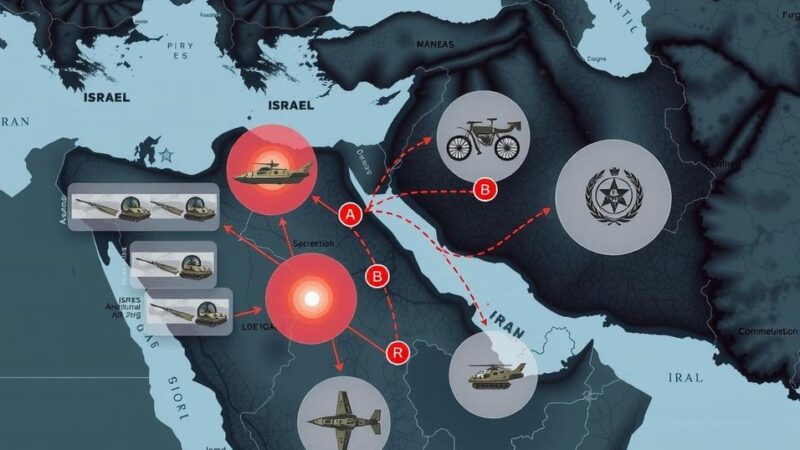

In February 2024, Sudan’s state-owned Mineral Resources Company reported gold production reached 64 tonnes, up from 41.8 tonnes in 2022, generating $1.57 billion from legal exports. Nevertheless, nearly half of this production is reportedly smuggled out of the country. Gold mined from regions controlled by the Rapid Support Forces often goes through Chad, South Sudan, and Egypt before reaching the UAE.

Recently, Sudan initiated legal proceedings against the UAE at the International Court of Justice, accusing it of complicity in genocide linked to the RSF’s activities in Darfur. Despite the UAE denying these allegations, the nation plays a pivotal role in draining Sudan’s gold resources, accounting for 90 percent of the state’s legal gold exports.

Several operations are central to Sudan’s gold production, with the Kush mine, managed by Dubai-based Emiral Resources, resuming operations to produce significant gold yields monthly. The UAE’s commodities exchange signifies the nation’s rise as the world’s second-largest gold exporter in 2023, and it has become a major destination for African gold, including illicit sources.

Despite the UAE’s policy on responsible gold sourcing, experts argue that effective implementation is lacking. Suspicion persists regarding the sustainability of the conflict-gold market, particularly as RSF commander Mohamed Hamdan Daglo has maintained control over substantial gold mining operations. This financial power has reportedly allowed him to establish a mercenary network and support continued armed conflict.

Daglo’s wealth, derived from a vast network of companies, has reportedly enabled him to finance the RSF’s military efforts significantly. The ongoing illicit gold trading, often transported through various countries, underscores the complexities of Sudan’s wartime economy and the UAE’s role in perpetuating these dynamics.

In conclusion, Sudan’s wartime gold trade predominantly flows to the UAE, enriching military forces amid ongoing conflict. Despite rising production figures, much of this gold is smuggled, bypassing strict controls. The interlinked nature of Sudan’s gold exports, accusations of complicity against the UAE, and the financial networks supporting conflict raise serious concerns about the effect of such dynamics on regional stability and peace efforts. Addressing these issues is crucial for both Sudan and the international community.

Original Source: www.rfi.fr