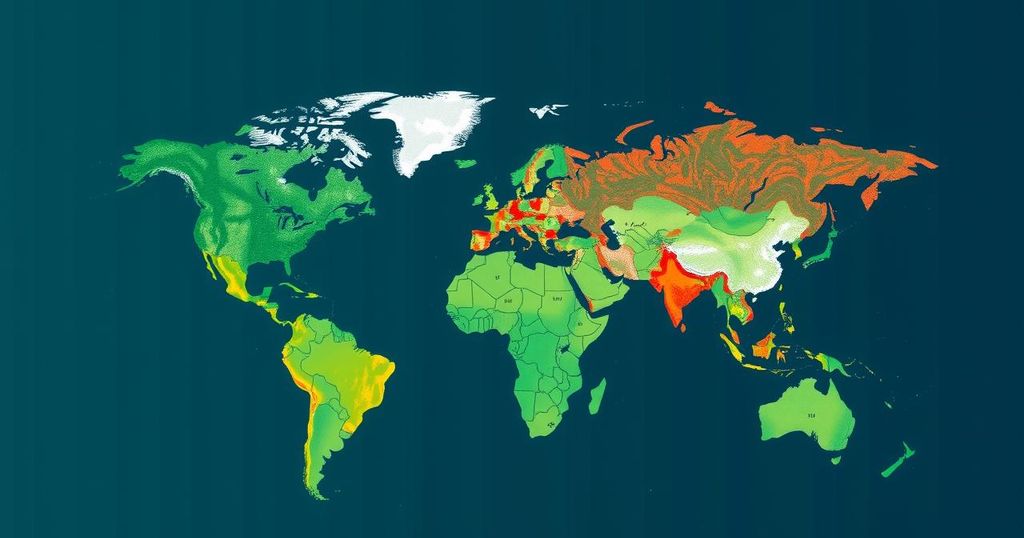

Foreign officials at the U.N. climate change summit are pushing for solidarity levies—de facto global climate taxes—targeting various industries to raise over $100 billion annually for green energy in developing countries. This effort is in response to anticipated shifts in U.S. climate policy under President-elect Donald Trump, who previously withdrew from the Paris Agreement. Discussions involve potential taxation of shipping, aviation, and other sectors, reflecting creative attempts to secure climate funding.

At the current United Nations climate change summit, foreign government officials are advocating for the implementation of so-called “solidarity levies”—a form of de facto global climate taxes. These levies would target various industries to generate substantial funds for green energy development in developing countries. Nations such as France, Spain, and Kenya are spearheading efforts to craft a sustainable funding model that could yield upwards of $100 billion annually, particularly focusing on the shipping and aviation sectors, among others. This push comes as President-elect Donald Trump is expected to renew his previous skepticism towards international climate agreements, thus prompting climate advocates to seek alternative financing avenues.

The discussions surrounding these potential climate funding measures illustrate the challenges faced in securing financial support for poorer nations. With Trump’s anticipated exit from the Paris climate accord, officials are exploring innovative means to address funding gaps. Not only could the shipping and aviation industries face taxation, but sectors such as cryptocurrency, fossil fuel production, and even wealth redistribution from affluent individuals may also be included in the proposed levies. It remains ambiguous whether the revenues generated will actually benefit developing nations or simply support industry decarbonization efforts.

There exists a precedent for these discussions, as many airline companies voluntarily participated in a carbon offset agreement in 2016. However, this agreement was not structured for revenue generation. The exploratory task force is considering how to leverage existing duties on airline tickets across multiple countries to potentially raise $164 billion. Furthermore, recent studies indicate that high-profile events, including U.N. climate summits, contribute disproportionately to greenhouse gas emissions as attendees frequently utilize private jets for travel.

The initiative for global climate taxes stems from a growing recognition of climate change’s disproportionate impact on developing countries, which often lack the resources to implement green energy solutions. Major discussions on financial support for these nations have historically been contentious. With a U.S. leadership perceived to be increasingly disinterested in international climate agreements, particularly under Donald Trump, global stakeholders are seeking innovative financing solutions to ensure climate measures remain sustainable and effective. The focus on imposing solidarity levies highlights the urgency and creativity needed to address financing in a politically charged atmosphere.

In summary, the advocacy for solidarity levies at the U.N. climate summit reflects a concerted effort by foreign officials to establish a framework for global climate taxation aimed at financing green energy initiatives in poorer nations. The potential targeting of key industries, coupled with the uncertainty of the actual beneficiaries of this funding, underscores the complexity of international climate negotiations especially with a U.S. administration potentially reluctant to support such initiatives. Moving forward, it will be critical for stakeholders to navigate these challenges to ensure effective and equitable climate financing.

Original Source: www.shorenewsnetwork.com