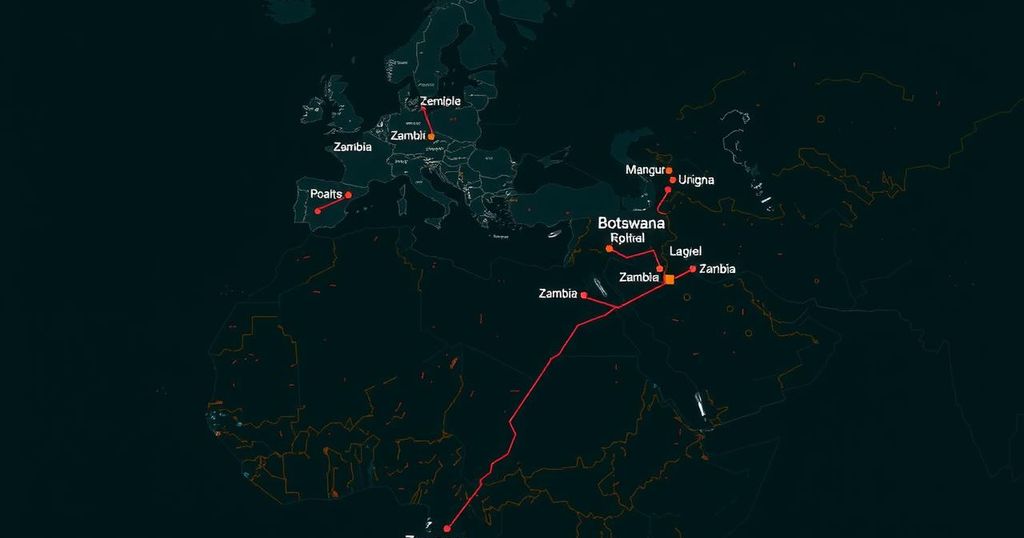

Standard Chartered PLC plans to sell its wealth and retail banking operations in Botswana, Uganda, and Zambia while continuing to serve its corporate clients in these regions. This strategic move is aimed at optimizing income growth and enhancing overall returns, reaffirming the bank’s commitment to the African market. The potential exit is deemed non-material to the overall group performance.

Standard Chartered PLC has disclosed its intention to divest its wealth and retail banking divisions in Botswana, Uganda, and Zambia. Despite this strategic move, the bank will continue to meet the cross-border requirements of its global corporate and financial institution clientele in these regions. This decision aligns with the bank’s focus on optimizing income growth and returns, reinforcing its strategic priorities as outlined in the third-quarter results.

Standard Chartered PLC has a long-standing presence in Africa, having operated for 170 years. Recently, the bank has committed significant investments across the continent, aiming to strengthen its market position. The bank’s decision to explore the exit from certain retail operations emphasizes its strategy to streamline its operations and focus on areas of more distinct client offering, particularly in wealth management where it has seen substantial growth.

In summary, Standard Chartered PLC is undertaking a strategic assessment that has led to its decision to exit wealth and retail banking operations in Botswana, Uganda, and Zambia. This move aims to concentrate resources more effectively while continuing to serve its corporate and institutional clients globally. The overall impact on the bank is expected to be minimal, as it seeks to enhance its profitability and market performance.

Original Source: www.proactiveinvestors.co.uk