A coalition of climate-vulnerable nations is advocating for a reform of the credit rating system to reflect climate resilience efforts. Current ratings primarily focus on economic risks posed by climate change, often disadvantaging Small Island Developing States. The proposed changes aim to recognize proactive strategies in climate adaptation, potentially unlocking vital investments and promoting a fairer global financial landscape.

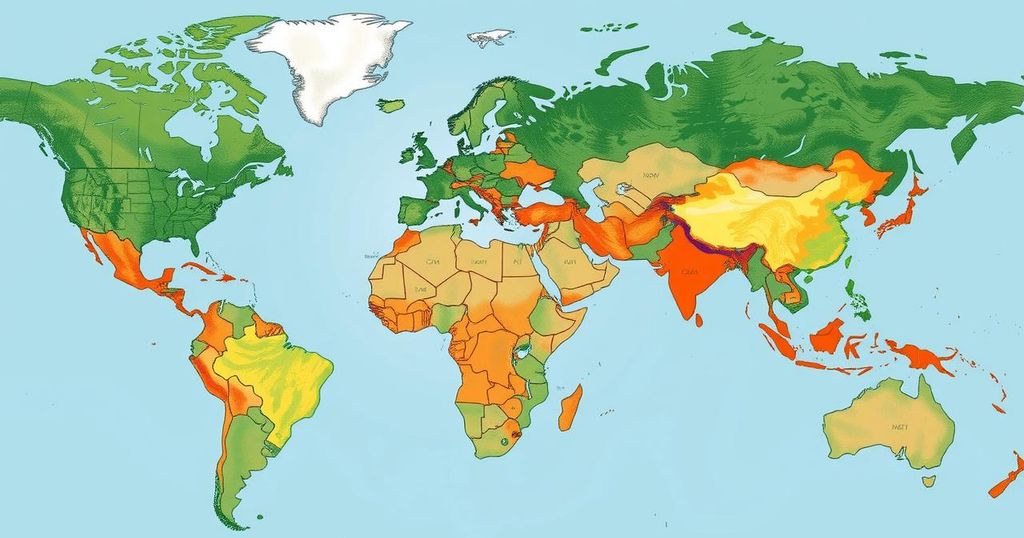

A coalition of nations significantly affected by climate change is advocating for a reform of the existing credit rating system to incorporate measures for climate resilience. This issue was a focal point at the recent UN assembly held in New York. Current credit ratings, issued by agencies such as Moody’s and S&P Global, predominantly emphasize economic threats posed by climate change, thereby neglecting the resilience efforts made by vulnerable countries. This oversight is particularly detrimental for Small Island Developing States (SIDS) like Cuba and the Maldives, which often receive low credit ratings that restrict their access to vital investments. Advocates are therefore urging for a system that evaluates both the risks and the proactive strategies employed by these nations to adapt to climate change, aiming to fulfill the $1.3 trillion climate finance target established for the finance summit in Spain set for 2025. Additionally, the emergence of an African ratings agency could enhance equitable assessments in the financial landscape.

This demand for reform is crucial for unlocking investment opportunities particularly in regions that face significant climate challenges. Presently, the credit rating framework fails to adequately value the advancements made by vulnerable nations in strengthening their climate resilience, consequently resulting in missed investment chances that are essential for global sustainability. A reformed credit rating approach could catalyze new investment flows into these high-value regions.

The broader implications of these proposed changes extend towards fostering a more equitable financial framework. By including climate resilience in credit assessments, the initiative seeks to challenge conventional norms and advocate for financial fairness on a global scale. Such reforms bear substantial economic and environmental significance, empowering developing nations to align their financial incentives with sustainability goals and ultimately influencing broader international financial policies.

The current global financial system often overlooks the specific challenges faced by climate-vulnerable nations, particularly regarding their credit ratings. These nations are frequently assigned low or sub-investment ratings due to the perceived economic instability caused by climate change. However, the advocacy for a revised credit rating approach highlights an essential shift towards recognizing the ongoing efforts by these nations to build resilience against climate impacts. This shift is particularly critical for Small Island Developing States, which are disproportionately affected by climate change yet are striving for sustainability and investment attractiveness.

In summary, the push for credit rating reforms by climate-vulnerable nations aims to integrate climate resilience into financial assessments. This change could unlock crucial investment opportunities while promoting equity in the financial landscape. It advocates for an inclusive approach that recognizes the proactive measures taken by developing nations to combat climate challenges, thereby fostering a more sustainable and resilient global economy.

Original Source: finimize.com