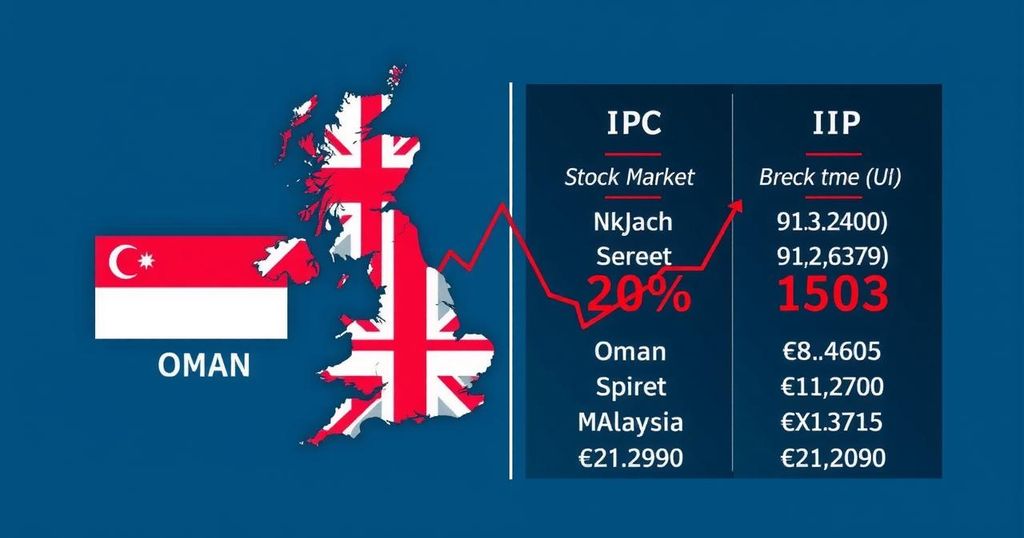

The UK stock market has seen a dramatic decline in IPO activity, dropping to 20th place globally as fundraising plummets to $1 billion, surpassed by smaller markets such as Oman and Malaysia. This downturn is attributed to low valuations and heightened competition from other financial hubs, with only a dozen firms listing in London this year. Experts suggest that significant reforms are needed to revitalize the market and regain investor confidence.

The UK stock market has experienced a marked decline in its initial public offering (IPO) performance, causing it to be outpaced by smaller markets such as Oman and Malaysia. As noted, fundraising from London IPOs has decreased by 9% this year to approximately $1 billion, resulting in the UK plummeting to 20th place in global rankings. Factors influencing this downturn include low valuations, a cautious domestic investor base, and intensifying competition from other financial hubs. Despite recent reforms aimed at revitalizing the London Stock Exchange, observers indicate more substantial changes may be necessary.

In 2023, only a handful of firms have opted for listings in London, with no entries among the top 100 global offerings. Notable comparisons reveal that countries like Greece and South Africa have hosted larger IPOs this year. The trend is shifting towards the Middle East and Asia; for instance, a recent $2 billion IPO by Talabat in Dubai has emerged as the largest tech IPO worldwide this year. Even on the domestic front, the appeal of London is waning as major companies, including notable fintechs, express preference for US exchanges, citing unfavorable valuation conditions in the UK markets.

Market dynamics reflect a broader theme of decline, characterized by increasing mergers and acquisitions that have led to the departure of roughly 45 companies from London’s stock exchange in 2023 alone. This trend underscores the diminishing analyst coverage and low trading multiples associated with many mid-cap firms. Consequently, private equity firms have been acquiring these perceived undervalued entities, evidenced by substantial buyouts executed by major firms this year.

The ongoing pressure on the London IPO ecosystem has also adversely affected local advisory firms, with significant drops in revenues reported across numerous investment firms. However, bankers maintain that equity capital markets remain active outside of IPOs, highlighted by a 60% year-on-year increase in the volume of new stock offerings. Furthermore, the London Exchange has been attracting select overseas listings, although not all these are capital-generating.

UK authorities are actively addressing these issues by implementing significant revisions to listing regulations, which are aimed at attracting additional tech offerings and easing disclosure requirements. Optimistically, analysts hold out hope for a resurgence of enthusiasm in the market, provided there is sufficient momentum to encourage new listings.

The UK stock market, historically a leading global venue for initial public offerings, is currently facing serious challenges as it falls behind smaller international markets, particularly in terms of IPO fundraising. The decline can be attributed to several factors, including a risk-averse investor climate, unfavorable valuations, and increasing competition from financial centers in the Middle East and Asia. This situation has prompted discussions regarding the necessity for comprehensive reforms to invigorate the UK’s market appeal. Recent years have witnessed a stark transformation, with significant IPO activity shifting to the Middle East, where countries are actively developing their capital markets through substantial national listings. This competitive landscape has intensified the pressure on London’s position as a premier destination for public offerings, leading to a re-evaluation of the UK’s regulatory environment and market practices.

In summary, London’s IPO market is currently facing formidable challenges that have resulted in its relative decline, as evidenced by its drop in global rankings and the notable exodus of companies to other markets. While initial efforts have been made to reform the listing landscape, it remains clear that attracting new listings will require a concerted and sustained effort from market participants and regulators alike. As the competition intensifies globally, the future resilience of the UK stock market hinges on its ability to adapt to prevailing economic conditions and investor expectations.

Original Source: www.livemint.com