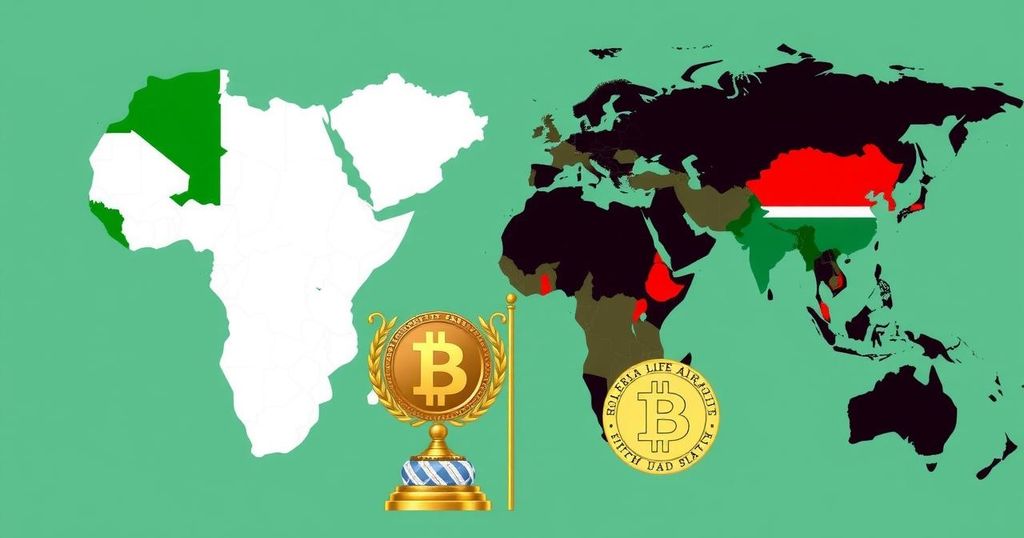

According to a new Consensys report, Nigeria and South Africa rank as global leaders in cryptocurrency ownership, with rates of 73% and 68%. Practical uses of cryptocurrency are driving this trend, despite Africa’s small share of global transaction volumes. Significant growth has been observed in cryptocurrency usage, with $125 billion received in on-chain value between July 2023 and June 2024 and nearly universal awareness in these countries.

A recent report published by Consensys identifies Nigeria and South Africa as prominent leaders in global cryptocurrency ownership, recording ownership rates of 73% and 68% respectively. This significant market presence can be attributed to practical applications of cryptocurrency within Africa, including its use as a hedge against inflation, facilitating business transactions, and conducting small retail purchases. This trend is further supported by a Chainalysis report indicating that sub-Saharan Africa leads in decentralized finance (DeFi) adoption, largely because of the low prevalence of traditional bank accounts.

Despite the increasing integration of cryptocurrency across the continent, Africa has thus far only accounted for 2.7% of global transaction volumes, highlighting its relatively smaller economic scale. Nonetheless, the region demonstrated remarkable growth in cryptocurrency usage with an impressive $125 billion in on-chain value received between July 2023 and June 2024. Furthermore, the Consensys report emphasizes a profound awareness of cryptocurrency among the populations of Nigeria and South Africa, with familiarity rates reported at 99% and 98% respectively.

The rise of cryptocurrency in Africa is heavily influenced by the unique economic landscape of the continent. Many Africans see cryptocurrency as a solution to issues like inflation and poor access to traditional banking services. This has led to a high rate of adoption, particularly in Nigeria and South Africa. As the region’s economies continue to grow, cryptocurrency offers potential avenues for secure transactions and investment opportunities. Moreover, the interest in decentralized finance suggests that Africans are actively seeking alternatives to conventional financial systems.

In conclusion, Nigeria and South Africa are making significant strides in cryptocurrency ownership, driven by practical applications that meet the needs of their respective economies. The high levels of awareness and adoption indicate a promising future for cryptocurrency usage in Africa, despite its current share of global transaction volumes being relatively small. Continued growth in this sector may help reshape financial landscapes and offer innovative solutions tailored to the continent’s challenges.

Original Source: iafrica.com