Visa reports a 29% increase in online transactions and a 27% rise in total payments in Trinidad and Tobago during Black Friday 2024. This growth is driven by a 35% surge in contactless payments, showcasing the increasing consumer preference for innovative payment technologies.

Trinidad and Tobago have experienced a notable boost in credit card transactions during the Black Friday shopping event, as reported by Visa. The Visa Consulting & Analytics team noted a remarkable 27 percent increase in total transactions compared to the previous year, driven primarily by a significant uptick in contactless payments, which surged by 35 percent. This trend emphasizes a growing consumer preference for efficient, secure, and innovative payment solutions.

Jorge Salum, the Country Manager at Visa Trinidad and Tobago, stated, “The surge in contactless transactions during this year’s Black Friday in Trinidad and Tobago underscores a compelling shift in consumers and businesses’ behaviours, showcasing a clear preference for this innovative payment technology.”

Additionally, online transactions witnessed a substantial rise of 29 percent, indicating a paradigm shift towards e-commerce. This is attributed to improved connectivity and mobile shopping capabilities in Trinidad and Tobago, contributing positively to the local digital ecosystem. The Visadata analysis encompasses transactions conducted on Black Friday, November 24, 2023, compared to the following year, excluding Visa Direct-related transactions.

Overall, these findings highlight the adaptability of consumers in Trinidad and Tobago in response to changing economic conditions while embracing digital commerce.

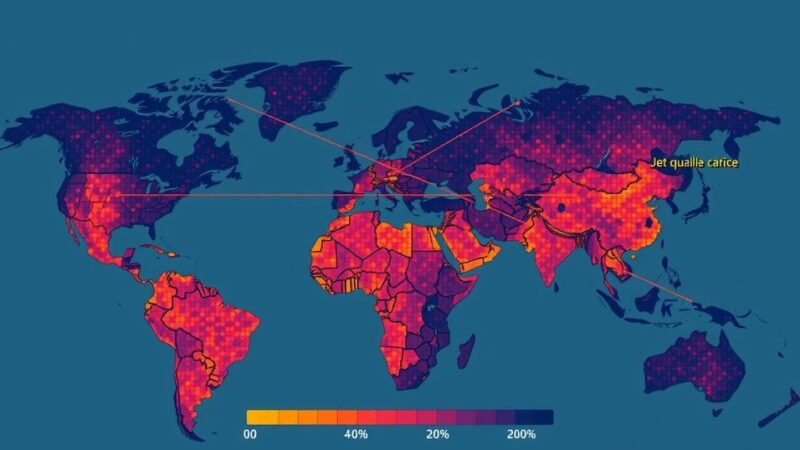

The analysis further provided insight into the broader region, including several Latin American countries, from which similar trends were observed in the context of increasing digital transaction methods, particularly emphasizing the expansion of mobile and online purchasing in today’s economy.

The increase in credit card transactions during Black Friday in Trinidad and Tobago reflects a broader trend of consumer confidence and the adoption of digital payments. With the emergence of technologies such as contactless payment systems, businesses and consumers are progressively shifting towards more convenient and efficient methods of transaction. This shift not only facilitates faster shopping experiences but also aligns with global trends highlighting the growing acceptance and reliance on e-commerce platforms, especially following the impacts of the COVID-19 pandemic.

In summary, Visa’s reports on Trinidad and Tobago’s Black Friday transactions underscore a year of significant growth in consumer spending, driven by the increasing preference for contactless payments and online shopping. The 27 percent rise in total transactions, coupled with the 29 percent surge in online purchases, illustrates the evolving landscape of digital commerce in the region. This trend not only reflects consumer confidence but also highlights the resilience of local commerce amidst changing macroeconomic conditions.

Original Source: tt.loopnews.com